by Krissy Brady

by Krissy BradyI love this time of year as a freelancer: with a new year just around the corner (yikes!), it’s the perfect opportunity to plan the changes you’re going to make to better your freelance lifestyle.

As freelance writers, it’s even more crucial to have a strong financial plan in place, since you have no one to depend on but yourself. The onus is on you to plan for emergencies, vacations, tax payments, and your retirement.

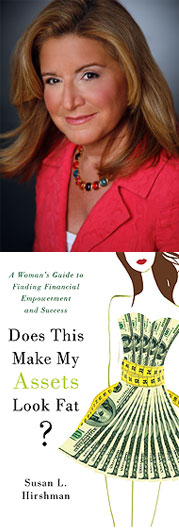

I caught up with Susan Hirshman—president of SHE LTD, a consulting firm focused on enhancing the financial literacy of women globally, and author of the fabulous Does This Make My Assets Look Fat?, a women’s guide to finding financial empowerment and success—to find out more about what you can to do to feel financially secure in your freelance lifestyle.

WOW: One of the biggest fears aspiring writers face is not making enough money from their writing to survive, which is why so many are reluctant to take the plunge. What tips would you offer to help ease their fears and go after their dream career?

Susan: Having a sense of control over your finances is essential if you want to live the entrepreneurial life. Cash flow is king here—thus, you want to make sure that you’ll be able to meet your expenses on a month-to-month basis without going into debt.

The first step is to have a keen understanding of your monthly spending plan—think in terms of fixed costs (i.e. rent, utilities, food, student loans, etc.) versus discretionary costs (gym memberships, clothing, entertainment, etc.). Don’t forget to include any additional fixed costs that you would incur being self-employed (for example, health insurance).

Compare your fixed costs to your savings—how many months would your savings cover? Is it enough time for your business to start generating sufficient cash flow? If the answer is yes, then do the same exercise and include your discretionary costs and compare. If there is a significant difference in ratios, you may want to examine some of your discretionary expenses. Can do you without?

The bottom line here is that if you know what you have to earn, as compared to what you spend, what you have will be a greater sense of control, which will give you peace of mind.

WOW: What are some of the financial benefits of being at a “day job” we have to take over as freelancers, and how do we go about preparing to do so?

Susan: There are three key areas to take over:

• Insurance

• Retirement

• Taxes

Insurance—health disability, life, LTC. Before you leave your day job, see if any of your plans are portable and if they fit into your budget. If not, before you leave your day job, investigate your other options. Freelancersunion.org is a good place to start.

Retirement and Taxes—talk to your CPA to gain a sense of the rules for setting up a retirement plan, estimated taxes and any other state or local taxes that your business will be subject to. If you don’t have a CPA, ask other freelancers, or go to CPAdirectory.com for a listing.

WOW: One thing I’m always guilty of is not being prepared at tax time. Are there things we should be doing throughout the year to prepare ourselves (e.g. taking a certain percentage of each paycheck and stashing it away, etc.)?

Susan: At tax time, you need to have your income and expenses organized. The key is to keep your business and personal expenses separate during the year. It’s important then to setup a separate checking account and credit card as soon as you go out on your own.

Also, use your credit card as often as you can for your business expenses. Many credit cards will give you a year-end summary of your charges, categorized by type of expense.

And as stated above, work with a CPA to understand the what and when of your taxes, and devise a plan so it’s not a last-minute scramble.

Finally, keep an electronic well-documented calendar—so you can always tie your expenses to your activity.

WOW: I’ll be the first to admit I’m a total spend thrift. What are ways we can cut costs as freelancers, without feeling like we’re losing the standard of living we enjoy?

Susan: It’s not always about cutting costs—it’s about spending your money on things that are really important to you. Your basic fixed expenses don’t change (unless you want to move, etc.)—thus, the play is with your discretionary expenses.

A good way to think about your discretionary expenses is to break them into must-haves, nice-to-haves, and splurges. For example, although your gym membership is discretionary, you feel that it’s vital to your well-being and thus non-negotiable; therefore, it’s a must-have. Whereas, your once-a-month live concerts are nice to have, and wouldn’t feel horrible to lessen them to every other month, and so on. It’s all about trade-offs and choices.

WOW: Are there certain financial tools you feel without a doubt should be in a freelance writer’s arsenal?

Susan: Mint.com is a great place to start.

WOW: What do you consider to be your “ultimate” financial tip—the one you always swear by?

Susan: The tip I always swear by is: knowledge is power. Have a strong understanding of what you have, what comes in, what goes out, what you want, and your plan to get there.

For more information, check out Susan’s website at www.myfatassets.com.

About Krissy Brady

Krissy Brady is the owner of Krissy Media Ink, a blog dedicated to simplifying the writing life. She’s also an eBook writer for Sterling & Stone, specializing in eBooks for indie authors. Like most women, she wants to have it all… but first needs to figure out what that means. Keep in touch with Krissy on Facebook and Twitter for the latest writing-related information.

Great interview ladies! When I first started freelancing I didn't think about separating my personal and business accounts since it was only me. That turned into a mess at tax time, so I'm glad you pointed that out. :)

ReplyDeleteSusan, I love the title of your book!

I am a spend thrift, too--I LOVE to eat out! :) (And I don't like to cook. . .) Thanks for these tips-they are things I need to think about. I do not have separate business or credit card accounts either. Something to think about in the New Year!

ReplyDeleteHmmm...I don't separate personal from business as far as banking goes, but I do in my bookkeeping. Maybe that's ok then? Sounds like a good book I need to check out.

ReplyDeleteI'm so happy you enjoyed the interview ladies! I have a separate bank account for my business, but I have to say by tax time my bookkeeping is STILL a total mess, LOL!

ReplyDeleteIt's something I'm promising myself to improve upon in the new year. Now that I've shut down my web design business and am writing full-time, I won't have as many little accounts and things to keep track of, so it should go a LOT smoother.

Thanks to Susan, I'm going to use my credit card specifically for my business expenses - that should completely declutter my process. I've ordered her book, and can't WAIT to learn more. I love the title too Ang, lol, *snorts. :)

You know, a few years ago I even got very micro-managey with my bank accounts. I have 10 business checking accounts...10!! All with individual debit cards. One for each avenue of the WOW site (contest, classes, advertising, freelance, main, etc.), plus two for my graphic art business, AND I have individual PayPal accounts directly connected to the checking account for each one. I know it sounds crazy, but it makes things a lot easier. I can immediately spot which areas are lacking in revenue growth, which are prospering, and what needs work. I also can fit certain accounts into categories, which makes it easier at tax time. I can hand over any spreadsheets to my accountant without having to worry about him checking out what I purchased, where I went for lunch, and when I color my hair LOL, because they are all business expenses.

ReplyDeleteAnnie, I don't know if you need to have a separate account. I opened one about a year after I started freelancing when I started getting big contracts and contracting other freelancers. At first I didn't have a business license or business name so I just opened another personal checking account to keep things simple. But when I decided to give my freelance business a name, then I got a business license and opened a checking account and credit card with my business name on it. It depends on where you want to take your business, I guess. I had a lot of big corporations as clients and wanted to be as legit as possible to keep getting those contracts. Plus, I started outsourcing a lot of the work, so it helped keep things organized.